Digital-only Platforms and Open Innovation Tailwind for Fintech

More users adopted digital services in fintech, and thanks to digitalization for this. Most prominent fintech startups are trying to overcome vulnerabilities caused in this era of banking 4.0. Companies are pushing their capabilities more towards profitability than popularity by diversifying their offerings and services, by adopting open innovation, monetizing open opportunities, and orchestrating their ecosystem with collaborations. A plethora of opportunities emerging after a pandemic, new digital payments, and the rise of e-commerce (Which e-commerce technology best resonates with your business?) showed continued innovation and agility even in times of pandemic.

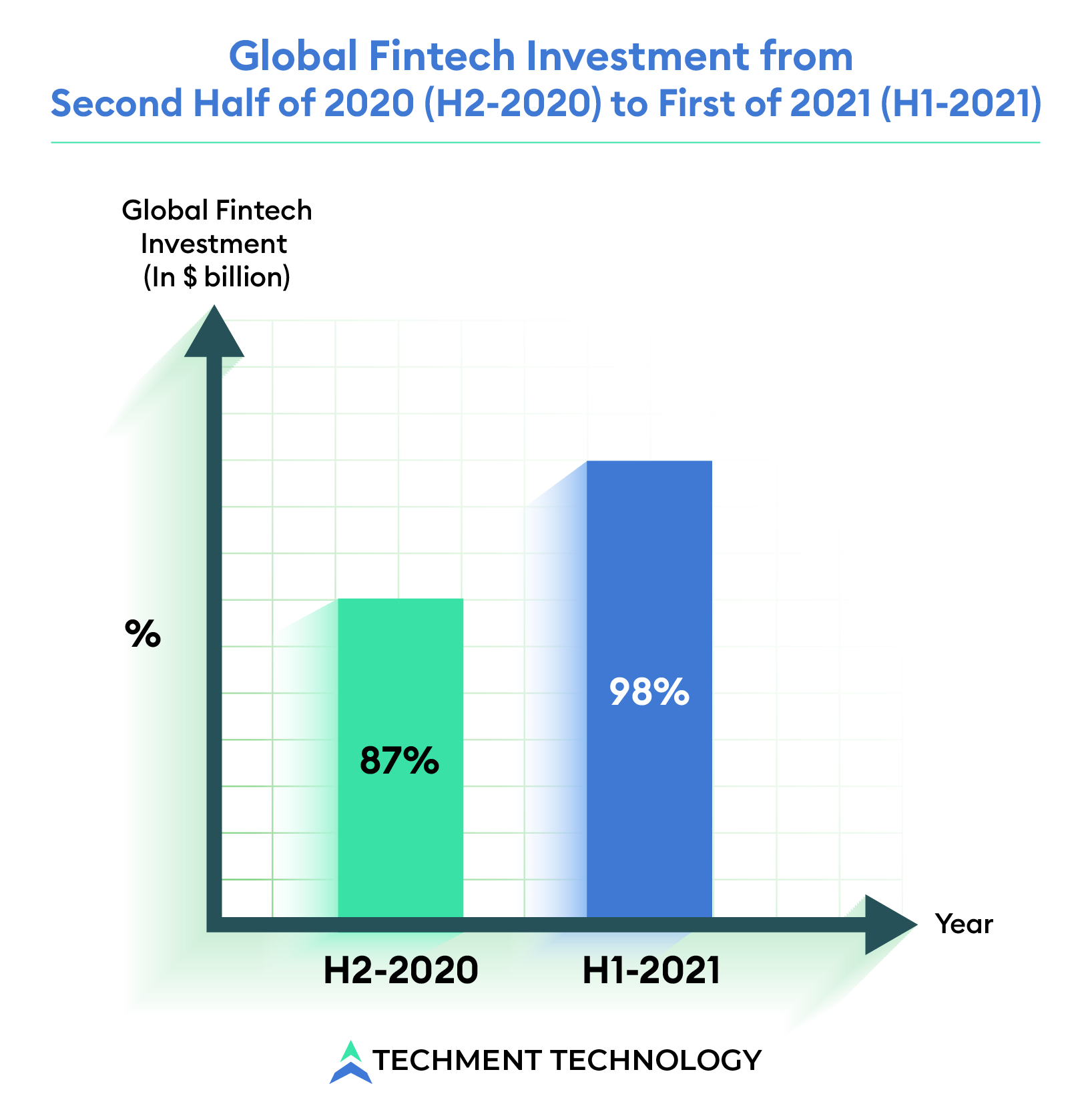

According to the KPMG International Entities’ report, global fintech investment continued its remarkable rebound in the first half of 2021, rising from $ 87billion in the second half of 2020 to $ 98 billion in the first half of 2021. Digital acceleration has brought a wide range of fintech hubs, sub-sectors, and strong activities in almost every region of the world have contributed to a strong start to 2021.

Fintech matured with the era of digitalization, which saw regulation, customer trust, digital capabilities, open innovation, etc., as support to financial institutions to survive in the fintech 4.0 era which is more personalized and fulfilling their business goals. The digital-only subsidiaries are nurturing their new ventures, which drive long-term growth and driving revenue.

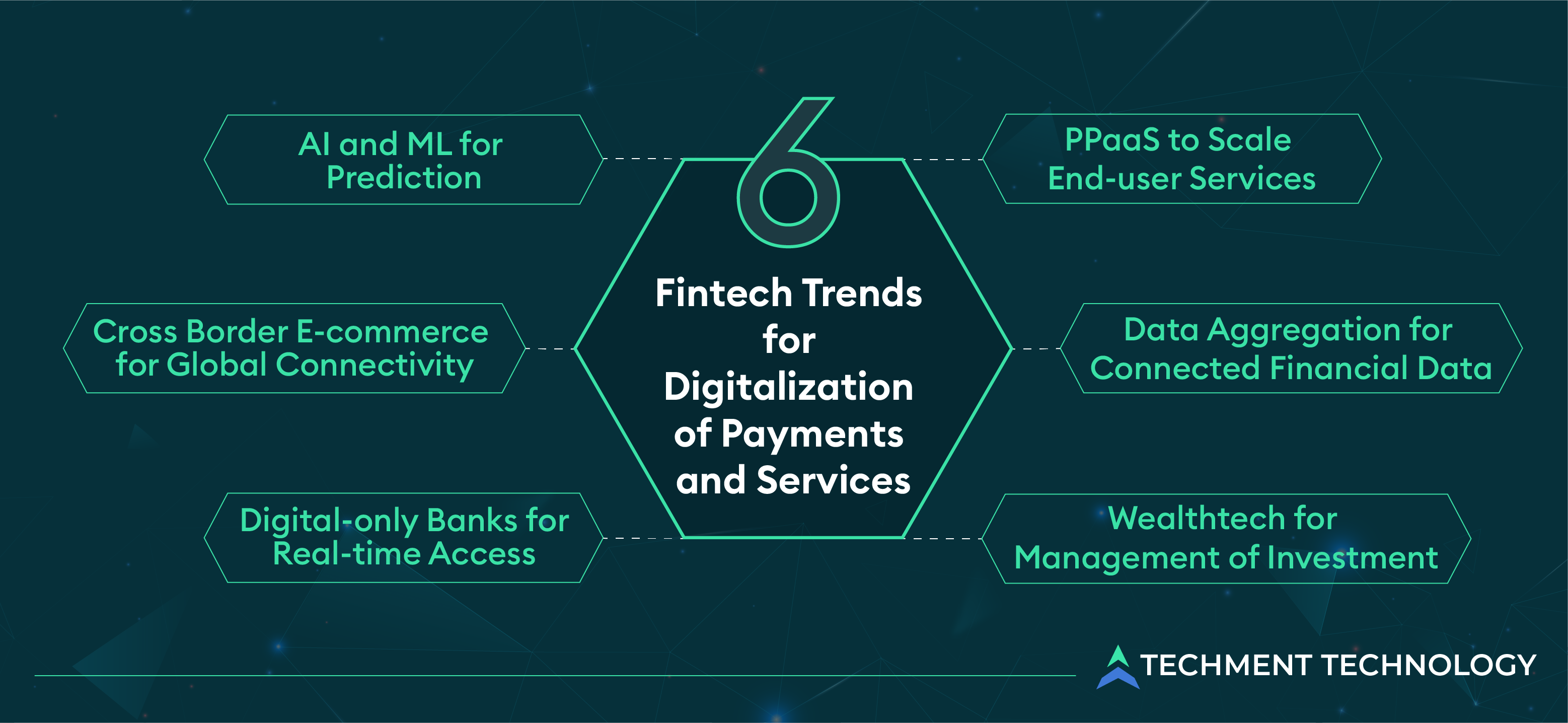

6 Fintech Trends for Digitalization of Payments and Services

The fastest revenue growth was seen in fintech, and it became the need of the hour for banks to ascend with the next wave to scale down the banks and financial services to mobile phones, iPad, tablets, or smartphones. What the future holds for 2022 will be interesting. So here are 6 fintech trends to keep an eye on:

1. AI and ML for Prediction: Financial fraud detection and asset management are the main use cases of ML in fintech. The analytical capabilities allow fraud detection in the financial and banking industry. According to the Mordor Intelligence report, the global artificial intelligence (AI) in the Fintech market was estimated at USD 7.91 billion in 2020, and it is expected to reach USD 26.67 billion by 2026. This shows fintech is moving closer towards using smart technologies.

From a customer support perspective, AI helps in credit risk management (Know how AI and other technologies support Fintech without borders and regulations?) and financial performance analysis. Data in financial firms become more prominent in tracking risks in digital transactions which pose risks and detecting micropayments so that they ensure no unethical activities take place. Other use cases of ML include:

2. Cross Border E-commerce for Global Connectivity: For taking global e-commerce to the next level, small technology-driven fintech startups and institutions are stealing the march on traditional players’ competitive edge. Fintechs are offering trade finance and other export solutions to MSMEs and e-commerce firms with their technology-driven solutions. This helps e-commerce firms to identify the creditworthiness of global borrowers, which becomes faster and more accurate.

The crying need for credits by MSMEs made i.e., lack of easy access to funding brought fintech to the picture.

3. Digital-only Banks for Real-time Access: Digital-only provides banking and financial facilities through digital platforms such as mobile, tablets, iPad, etc. Along with offering virtual banking services in the most simplified manner like electronic documents, real-time data, and automated processes, fintech is trying to leverage real-time intelligence, to provide more personalized customer information like spending alerts.

These virtual banks usually utilize cloud-based infrastructure for their core services along with support and operational activities. Cloud technologies (Know which strategic steps will help in cloud migration?) are still not used for core services in fintech but biggies are now adopting cloud for billing, credit, regular banking, customer payments, etc.

Cloud technologies are still not used for core services in fintech but biggies are now adopting cloud for billing, credit, regular banking, customer payments, etc. Frontline digital platforms need cloud technology that eliminates these barriers and can be more responsive to a rapidly changing market by simplifying onboarding and deployments. Cloud technology has other benefits than bringing new digital capabilities to customers faster by streamlining digital operations and reducing reputational damage caused by service disruptions.

4. Data Aggregation for Connected Financial Services: One of the best ways to improve the customer’s financial journey is to provide data connectivity and make it tokenized or credential-free, to increase user experience and customer satisfaction. Data aggregation has surpassed screen scraping in fintech which uses an API that brings aggregated financial and investment data. With fintech application development rising, APIs have emerged as a significant part of financial data sharing.

These APIs also enable fintech service providers to provide additional services or non-financial products like hospitality, entertainment, and retail through API-driven e-shops. Hence APIs are becoming a consumer-permission model that gives consumers control of their data, real-time access to instant fund transfer, and more.

5. PPaaS to Scale End-user Services: After banks’ traditional earnings plummeted, they have started adopting Payment Platform-as-a-service (PPaaS) to lower the barriers like the inability to provide on-demand service. PPaaS is a cloud-native environment that comes as a set of payment services, configured, and delivered to end-users. This enables third parties to use domestic, regional, and cross-border payments via a single interface.

This is a whole future-proof solution; an all-encompassing environment that provides financial service providers with access to all activities needed for secure and prompt payment processing.

FIS, an American fintech company known for its innovation in financial technologies, saw digital acceleration with the adoption of hybrid cloud models and customized its solutions by implementing APIs.

6. Wealthtech for Management of Investment: Wealthtech is another important trend in fintech for the management of investment and saving. It is a portmanteau of “wealth” and “technology” that manages the investments with the use of technologies like AI, ML, or advanced application of big data.

As the visibility of information is less in this sector, the safety of users, clients, and the company is important when utilizing data and analytics. Hence, in 2022 cyber security and behavioral analytics will be a new battleground for digital players in the wealthtech sector.

Unsurprisingly, with the need for market fluidity and greater emphasis on technology, traditional institutions investing in fintech technologies are growing at an exponential rate. The past few years have given us hybrids of different services with fintech, that offer mainstream organizations a way to upgrade their infrastructure and reduce costs in the long run. Fintech startups will continue to conquer more markets through strategic partnerships and consolidations.

Digital Platforms will Impel Embedded Finance in Future

Digital platforms are better positioned in fintech companies than ever. Customers now expect digital platforms to better meet their needs. With a deep understanding of customers, companies can drive innovation and play a critical role in the delivery of financial services to consumers. Banks will also use data in a better way to acquire new customers, better understand existing customers, tailor financial products accordingly, and generate repeat transactions.

As more non-traditional players enter the fintech segment, we can expect greater adoption of embedded finance by companies. Embedded finance (seamless integration of financial services into a traditionally non-financial service) will be a pickup stream for fast and hassle-free financial services, thus improving customer experience (CX). This will tend to reduce the barrier to the adoption of digital platforms and enable SaaS companies to add financial services to their core software products in a vertical market that will leverage financial services to solve the majority of their problems and enhance customer experience.

Integrating customer-focused solutions into software is always our priority. Techment Technology provides a seamless experience through the integration of different services through software for fintech companies. Get in touch with us for collaboration.

All Posts

All Posts